Dental Accounting Framingham: Improve Your Dental Office’s Cash Flow for 2021

Dental Accounting Framingham

Dental Accounting Framingham | We all had one of the toughest years of our lives since the Covid 19 pandemic days. The Dentistry profession is one of many businesses affected directly by the pandemic restrictions.

Government and medical regulatory authorities’ restrictions meant dentists could no longer practice as usual, apart from emergency cases. Fortunately, restrictions have lifted but recovering from the financial set back is needed for 2021.

The Financial Impact of COVID-19 on Dental Practices

Before we talk about a financial recovery plan, let’s take a look at how things have shaped up for the dental practices across the US since the early pandemic days.

Source: ada.org

Back in the last week of March 2020, only 5% of dental practices were open with “usual business”. 76% of the practices were seeing emergency patients only.

Fortunately, the situation has improved a lot since then. 33% of the business as of the second week in November 2020 have reported normal operations while 65% have been back to business with lower volumes of patient visitors.

There is much to elaborate on from these numbers though. As you can see the normal businesses’ curve dipped to lower rates after nearly getting to the 50% mid-year.

The economic impact of such a lower level of activities is beyond recovery in the near future. Even if dental offices return to normal, the customers’ confidence and economic powers will take time to restore the operations fully.

Unlike other businesses, there was little to go-by with the telemedicine and remote working business model for the dentistry sector too.

The full impact of the Covid 19 catastrophe for the dental practices will go beyond merely opening the offices again. Here is the other side of the picture so far.

Source: ada.org

Until recently, 50% of the total dental practices reported up to half of the patient volume. The rest of the 505 includes a cast majority (28%) with a patient volume of less than 100% too.

So how do you overcome the economic pitfall? Find out below.

Bouncing Back From the Financial Impact In 2021

You may currently have a moderately aggressive and fairly competitive financial model for your dental office. You’ll certainly have to make some quick changes to your financial model to make a strong come back in the year 2021.

Remodel Your Financial Plans

By financial plans, we mean the dentistry fee structure and payment plans too. If you’ve been into the annual budgeting, it’s time to create one. You wouldn’t have planned this much earlier for a tax planning purpose, but we all live in unprecedented times now.

Here are a few tips on your financial remodeling:

- Review your Fee structure and adjust it with the future economic forecasts in the mind

- Revisit your payment term plans and recovery methods

- Revise your accounts receivables more aggressively from existing customers

- Rethink your capital expenditures and financial budgeting model

- Avoid credit extensions and minimize the receivable delays

- Talk to a bank vigilantly on refinancing your business loans

- Talk to your regular clients about your new payment terms and communicate effectively

This seems a complicated task, rather it seems a collection of several financial plans rather than just a single comprehensive one. That’s right, this where you can think of a specialist to help you out of this financial imbroglio.

How a Dental CPA Can Best Assist Dentists

Dental Accounting Framingham | A dental CPA is perhaps your best option for financial recovery after a devastating financial last year. Dental CPAs are well-informed on accounting and financial resources as well as the practical requirements of the dental businesses.

Accountants and CPAs can offer you expert advice on tax credits and bookkeeping requirements. A dental CPA can offer you specialized and tailor-made advice that best aligns with the industry practices.

Benefits of choosing dental accounting Framingham

Evaluate the financial plan

Without an objective evaluation of your financial plans, there wouldn’t be an easy way out for the future. Talk to a dental CPA on your value-for-money aspects of the business.

Whether you have been allowing a relaxed payment plan or deferral receivable, it’s time to rethink it. You’ll need to follow an aggressive billing and payment recovery plan from now onwards.

Spend wisely

You can plan a financial annual budget with a dental CPA. You’ll need to spend the business money where it matters the most. Perhaps, you’ll need to renegotiate contractual terms with medical suppliers and banks about loans.

You may have planned for office renovations or buying new equipment. It may be wiser to defer a few expenses for the time-being or utilize a leasing option. Let’s talk about it…

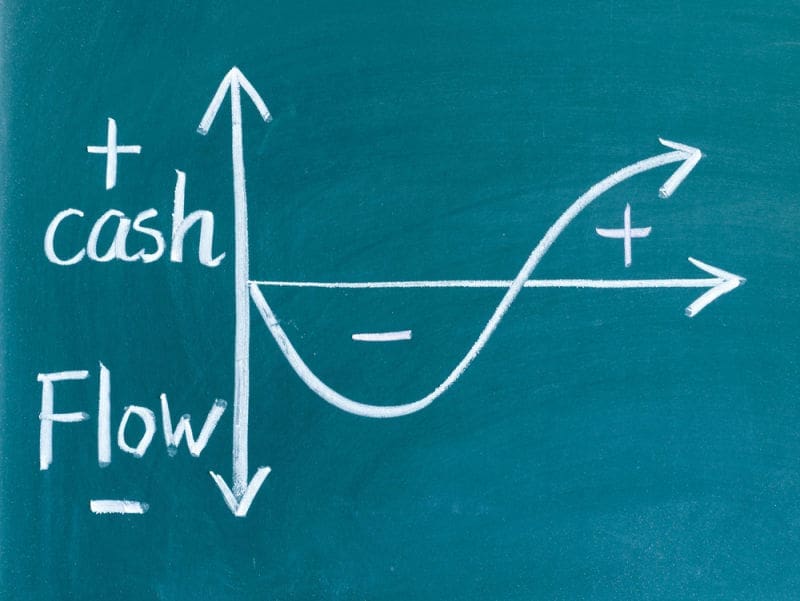

Maximizing the Cashflows

Primarily, there are two ways of cash flow maximization for any business, increasing sales and decreasing the receivable times. The best option is to find an optimum balance in both choices.

You can’t reduce your fee structure straight away, neither can you increase the patient’s visiting frequency quickly. Perhaps increasing the payment frequency is one thing where you can find a reprieve.

Tax Planning

Effective tax planning is an ongoing concern for dental offices rather than a Covid-19 recovery tool. However, there are certain tax provisions and tax deductions under the CARES and other relief options that will incur tax implications for your business.

Learn More

The road towards economic recovery is an uphill task, but together with sound financial planning, we can achieve success. Request a complimentary consultation from Ash Dental CPA. We have over 20 years of experience assisting dentists. Call (508) 458-6789 or request an appointment online. New clients are welcome.